Patching up a broken tax system: Why BEPS is not the solution to poor countries' tax problems | ActionAid International

BEPS and Intangibles: How does it impact IP tax structures? | CIP - The Anton Mostert Chair of Intellectual Property

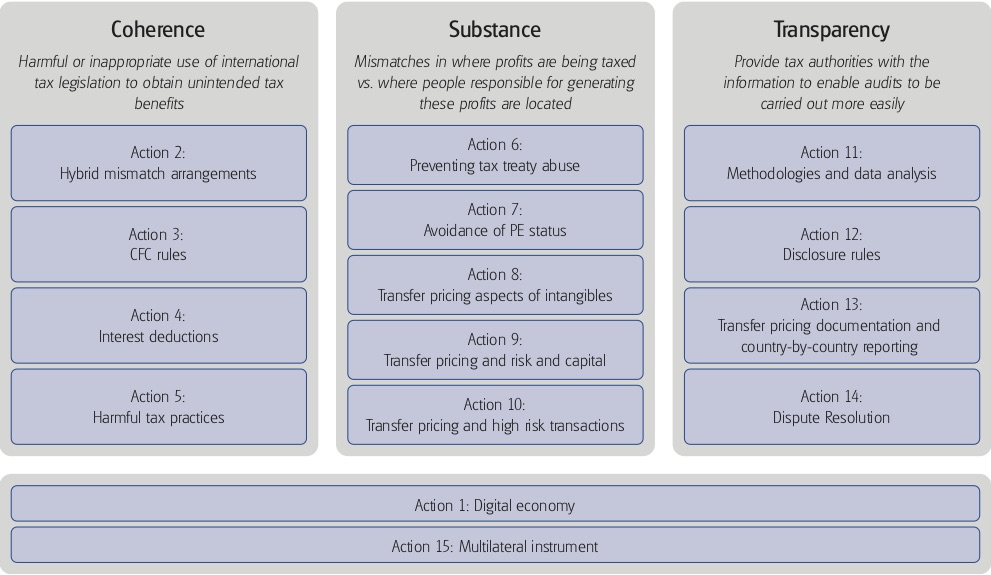

Base Erosion and Profit Shifting ((BEPS) | Deloitte | Tax Services | International Tax |Insights | Article

Broadening the business tax base and aligning tax rates across sectors | OECD Tax Policy Reviews: Seychelles 2020 | OECD iLibrary

Africa: Base Erosion And Profit Shifting: Reforms To Facilitate Improved Taxation Of Multinational Enterprises - Global Tax Justice

Membership of the Inclusive Framework on Base Erosion and Profit Sharing ( BEPS) as of November, 2021 : r/MapPorn

Base erosion and profit shifting OECD Tax Business Transfer pricing, world map, company, text png | PNGEgg

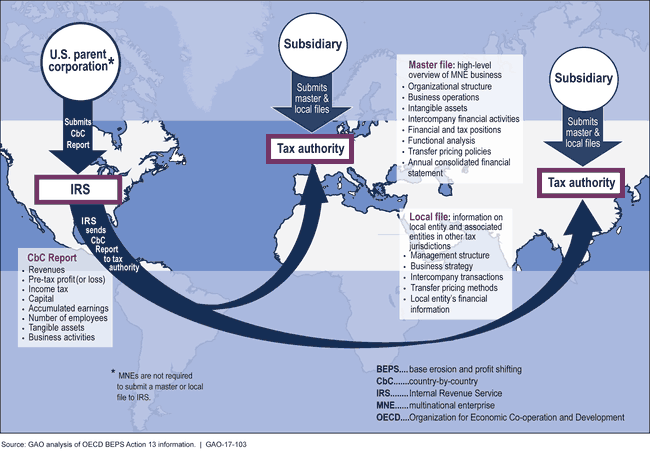

International Taxation: Information on the Potential Impact on IRS and U.S. Multinationals of Revised International Guidance on Transfer Pricing | U.S. GAO